how can derivatives be used to reduce risk

The main purpose of derivatives is to hedge the risk. Depending on how they are used derivatives can either increase or decrease the amount of risk in your portfolio says Bard Malovany a certified financial planner and principal at Aspect Partners.

/derivatives__shutterstock_398835340-5bfc2f1ac9e77c0051449058.jpg)

How Can Derivatives Be Used For Risk Management

Investment banks commercial banks financial services corporations pension funds mutual funds exchange traded funds hedge funds and private.

. In 2003 the last year in our sample 17 of the 19 banks using credit derivatives 493 of the banks in 2003. The asset can be equity or commodity. Futures and other derivatives can be used either as highly leveraged speculations or to hedge and thus reduce risk.

For example an importer whose profit falls when the dollar loses value could purchase currency futures that do well when the dollar weakens. Holding a derivative contract can reduce the risk of bad harvests adverse market fluctuations or negative events like a bond default. Flexibility Derivatives can be used with respect to commodity price interest exchange rates and equity price.

Using Derivatives to Decrease Risk by Hedging However derivatives can also be used to hedge away the risk of certain characteristics in certain strategies and is often used to reduce currency risk. Risk Reduction Derivatives can protect your business from huge losses. Derivatives are contracts that allow businesses investors and municipalities to transfer risks and rewards associated with commercial or financial outcomes to other parties.

Derivatives to reduce its credit risk exposure is whether the bank is a net buyer of credit protection. Swaps can be used to reduce risk by locking in a fixed rate when you have exposure to a floating rate. How can derivatives be used to reduce risk.

Holding a derivative contract can reduce the risk of bad harvests adverse market fluctuations or negative events like a bond default. Hedging means it helps to reduce the risk but it does not necessarily eliminate the risk. Briefly describe each of the following financial institutions.

A derivative is used pr. Some of the common derivative instruments are Futures Options Swaps. They classify mutual funds as users and non-users of derivatives since they do not have data on the funds intensity of derivatives use.

View the full answer. It can be used to minimise risk. A recent addition to the risk-management toolbox is the credit-related derivative and its variants.

This activity is known as hedging. Derivatives are contracts that allow businesses investors and municipalities to transfer risks and rewards associated with commercial or financial outcomes to other parties. Can be used to hedge or reduce risk.

Generally conducted where a. Can derivatives be used to increase risk. Our writers will create an original Study on how Derivatives Can Reduce Risk Finance Essay essay for you Create order For that it is need to allow the investor.

This activity is known as speculation. In most situations risk exposure can be mitigated by one or more of the following techniques. Derivatives use with increased risk exposure p.

Basically derivatives can be used to hedge on one of your current positions. 100 2 ratings A derivative is a security that derives its value from an underlying asset. Three common ways of using derivatives for hedging include.

Alternatively derivatives can be used by investors to increase the profit arising if the value of the underlying moves in the direction they expect. A derivative securitys value is derived from the price of another security eg options and futures. A derivative securitys value is derived from the price of another security options and futures Can be used to hedge or reduce risk.

Derivatives can be used to mitigate the risk of economic loss arising from changes in the value of the underlying. Derivatives are based on the behaviour of the basic assets. Businesses enter futures contracts to reduce the risk related to the volatility of commodity prices.

In fact derivatives allow you. For example you may hold US stocks because you believe over the long term that they will generate strong returns. How can derivatives be used to reduce risk.

You agree to pay the fixed interest payment and the. How To Minimize Risk With Derivatives 1. Risk is probability of loss.

However it needs special precaution. Derivatives have a lot of purposes. Agreement to exchange payments in the future.

ALso speculators can use derivatives to bet. Koski and Pontiff compare risk measures and higher moments of the return distributions of mutual funds that do or do not use derivatives. If one of them is failing entering a derivatives contract can still give you positive profits.

These are the kinds of risks that derivatives can lessen. Hedging is a form of. An importer whose profit falls when the dollar loses value could purchase currency futures that do well when the dollar weakens.

When used properly derivatives can be used by firms to help mitigate various financial risk exposures that they may be exposed to. 1 by transferring the risk to an insurance company 2 by transferring the function that produces the risk to a third party 3 by purchasing derivative contracts 4 by reducing the probability that an adverse event will occur 5 by reducing the magnitude of the loss associated with an. How can they be used to reduce or increase risk.

Risk management involves a process of risk identification measurement and evaluation and finding a. Currently derivatives are widely used to mitigate and reallocate the financial risk related to changes in interest rates exchange rates stock prices and commodity prices. Derivatives are sometimes used to hedge a position protecting against the risk of an adverse move in an asset or to speculate on future moves in the underlying instrument.

By swapping debt terms fixed for variable your exposure to future interest rate fluctuations is eliminated eliminating interest rate risk.

What Are Financial Derivatives The Motley Fool

Green Chemistry Principles Reduce Derivatives Environmental Chemistry Chemistry Fuseschool Youtube

Pin On Glory Investing Education Stock Market

International Derivatives Group Derivatives Market Contract Management Derivative

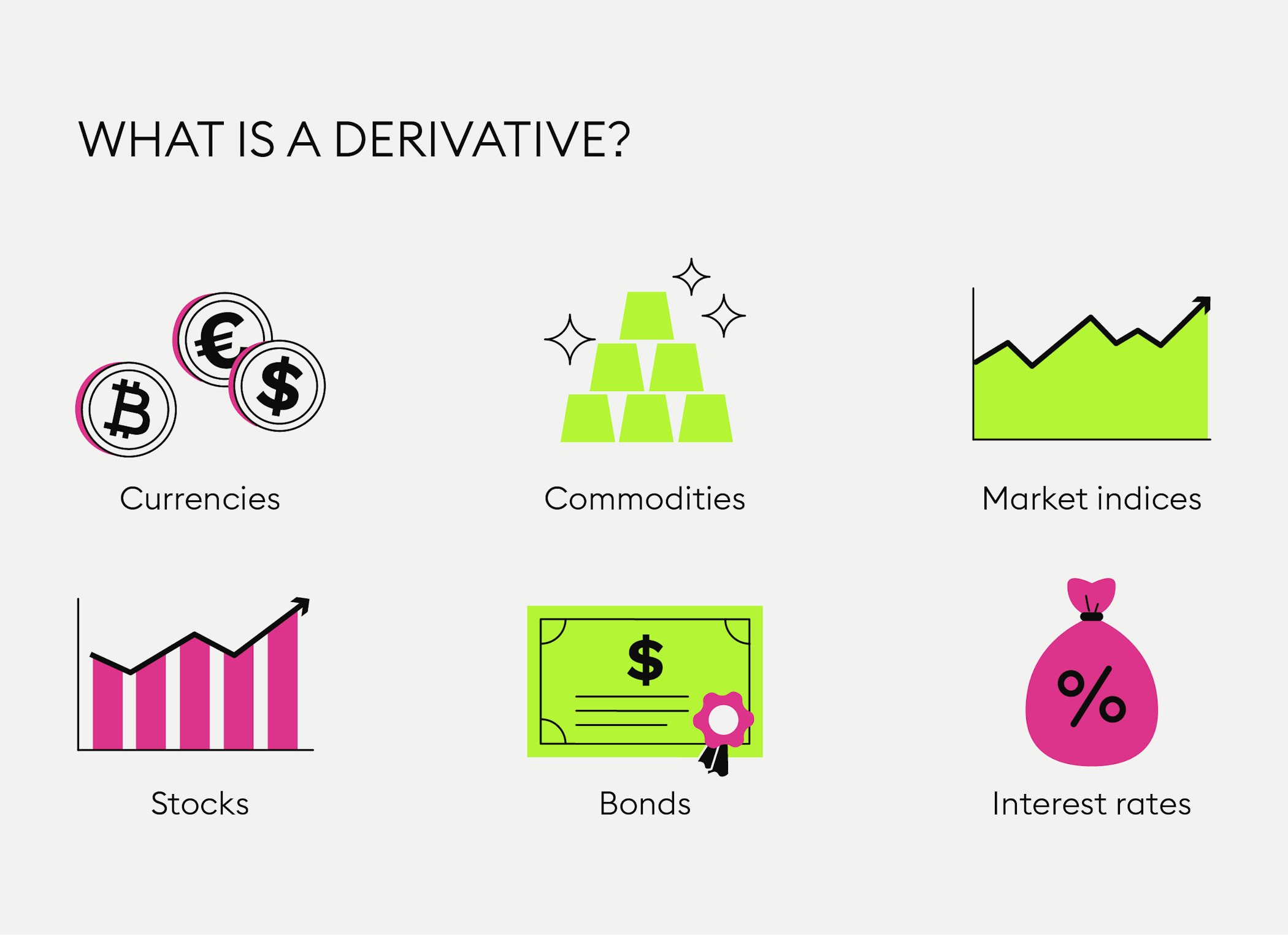

What Is A Derivative Bitpanda Academy

Uses Of Derivatives In Portfolio Management Video Lesson Transcript Study Com

People Or Firms Trading Otc Derivatives Are Required To Clear Them Through A Central Clearing Party But How Can Thi Risk Management Concentration Pension Fund

Derivative Investment One Of The Best Alternative Investments Option Financial Asset Related Contract Between Tw Investing Investment Tools Best Investments

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

0 Response to "how can derivatives be used to reduce risk"

Post a Comment